Radionuclides in Fracking Wastewater

February 8, 2014MA Has Double the Jobs in Clean Energy That PA Has in Natural Gas

February 18, 2014By Charles Komanoff, Carbon Tax Center, 1/31/14

The Carbon Tax Center told the U.S. Senate Finance Committee today that an economy-wide tax on the carbon content of coal, oil and gas will cut U.S. CO2 emissions more than twice as fast as proposed clean-energy subsidies delivered as tax credits.

This finding leads a new 22-page analysis, “Design of Economic Instruments for Reducing U.S. Carbon Emissions”, that we submitted today to Senate Finance Committee Chair Max Baucus. Our analysis is in the form of “Comments” on a Committee “Discussion Draft” that proposes replacing 42 federal energy tax subsidies with either credits for “clean (low-carbon) electricity” production and “clean fuels,” but also asks for input on the merits of a tax on carbon pollution instead.

Our comments can be boiled down to this ringing conclusion: A carbon tax will do everything the clean-energy credits will do, and much more. While simplifying and rationalizing the current hodgepodge of energy subsidies is all to the good, only a carbon tax can course through our entire economy and reward energy efficiencies and conservation along with low-carbon production.

Moreover, with the right design, a carbon tax can protect lower-income families and energy-intensive U.S. industries alike, at no cost to the Treasury. In contrast, even the proposed streamlined clean-energy subsidies could cost taxpayers more than $30 billion a year.

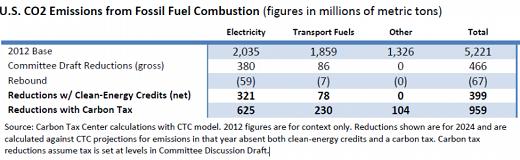

We performed our analysis using the Carbon Tax Center’s carbon tax spreadsheet model, which may be downloaded via this link. With the model, we estimated that the proposed subsidies would reduce U.S. carbon dioxide emissions by roughly 400 million metric tons a year, whereas an economy-wide carbon tax set at the same level as the subsidies would eliminate 960 million metric tons of emissions. (For comparison purposes, U.S. carbon dioxide emissions from burning fossil fuels totaled 5,221 million metric tons in 2012, the last year for which data are available.)

The Senate Finance Committee’s Dec. 18 statement, Baucus Unveils Proposal for Energy Tax Reform,” is available by clicking here. That two-page letter contains a link to the Committee staff’s 8-page discussion draft, which solicited comments on both the proposed subsidies realignment and on alternatives that would tax carbon emissions directly.

Our comments were submitted on behalf of the Citizens Climate Lobby and the Citizens Climate Education Corp. CCL/CCEC are the most visible and vociferous grassroots organizations advocating for a revenue-neutral U.S. carbon tax, and we are proud to stand with them. CCL chapters and members across the U.S. submitted their own comments backing a carbon tax as well.

Our hope is that the Senate Finance Committee’s discussion draft signals a new interest in carbon taxing among the tax-writing committees on Capitol Hill . . . and that CTC’s comments along with those from others will persuade incoming Committee Chair Sen. Ron Wyden (D-OR) to convene informational and/or legislative hearings this year on the optimal choice of economic instruments to reduce U.S. carbon emissions. (Longtime Committee Chair Baucus is leaving the Senate to serve as U.S. Ambassador to China.)

In the interim, we believe that our comments stand as the first broad quantification of the relative efficacy of a carbon tax vs. energy subsidies (even rationalized ones) to reduce emissions. As the figures in the table indicate, a carbon tax wins hands down.

CTC’s comments were researched and written by CTC director Charles Komanoff and CTC senior policy analyst James Handley. Support for their preparation and submittal was provided by the Alex C. Walker Educational and Charitable Foundation. We are grateful for their support.

Find out more about the Carbon Tax Center

Find out more about the Citizens Climate Lobby

Additional comments to the Senate Finance from Boston CCL