The End of Growth in the Tar Sands

November 2, 2015Exxon Mobil Investigated for Possible Climate Change Lies by NY Attorney General

November 7, 2015By Ambrose Evans-Pritchard, The Telegraph, October 27, 2015

Oil, gas and coal companies face the mounting risk of legal damages for alleged climate abuse as global leaders signal an end to business-as-usual and draw up sweeping plans to curb greenhouse gas emissions, Bank of America has warned.

Investors in the City are increasingly concerned that fossil fuel groups and their insurers are on the wrong side of a powerful historical shift and could be swamped with exhorbitant class-action lawsuits along the lines of tobacco and asbestos litigation in the US.

“It is setting off alarm bells that there could be these long tail risks,” said Abyd Karmali, Bank of America’s head of climate finance.

Mr Karmali said the United Nations’ “COP21” climate summit in Paris in December is likely to be a landmark event that starts to shut the door on parts of the fossil industry. “It is a non-exchangeable, one-way ticket to a low-carbon economy,” he said.

Christiana Figueres, the UN’s top climate official, said 155 countries have already put forward detailed plans covering 88pc of global CO2 emissions, and others are expected to join before the deadline expires.

“It is unstoppable. No amount of lobbying at this point is going to change the direction,” she told a Carbon Tracker forum in London.

Mrs Figueres said the mood has changed entirely since the failed summit in Copenhagen in 2009. This time China is fully on board. “China is already spending more on renewables than any other country. It is going to introduce its own emissions trading scheme in 2017,” she said.

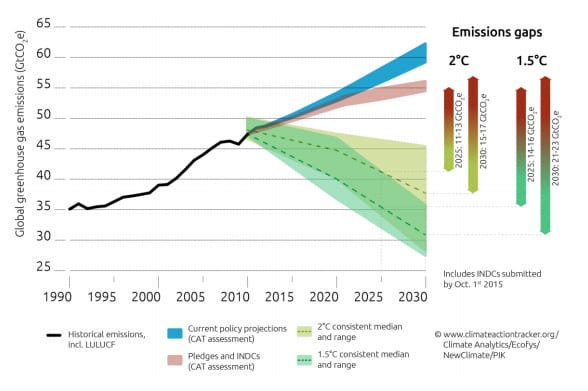

Mrs Figueres said the pledges are not yet enough to cap the rise in average global temperatures to two degrees Centrigrade above pre-industrial levels by 2100 – the “two degree world” deemed the safe limit.

But the Paris accord does promise to “bend” the trajectory to 2.7 degrees and will almost certainly be followed by a series of deals that brings the ultimate target within sight. “We think most countries will be able to over-achieve,” she said.

While the exact contours are still unclear, Paris is likely to sketch a way towards zero net emissions later this century. It implies that most fossil fuel reserves booked by major oil, gas and coal companies can never be burned.

A deal would also send a moral signal with legal ramifications. Mark Carney, the Governor of the Bank England, warned last month that by those who had suffered losses from climate change may try to bring claims on third-party liability insurance.

He specifically mentioned the parallel of asbestos claims in US courts, which have mounted over the years to $85bn and devastated some Lloyd’s syndicates.

Mr Carney said it would be “premature to draw too close an analogy with climate risks” and acknowledged that previous carbon lawsuits have failed, but he warned that the risk is “significant, uncertain and non-linear”. The UN has already floated ideas on compensation.

![]()

It is not hard to imagine who might launch legal claims for climate damage. The leader of the Pacific island of Tuvalu said his nation would be flooded by rising sea levels and would cease to exist by 2050 under current emissions trends, though owners of any low-lying coastal property in the US or the rest of the world might have a claim.

Lord Bourne, Britain’s under-secretary for energy, said at Chatham House this week that Tuvalu’s plight is an international scandal. “We can’t sit back and let it happen,” he said.

While it might be grossly unfair to blame the fossil fuel industry for what was in reality a phase of economic development that drove progress and lifted billions out of poverty, individual companies might get into trouble if internal documents and emails come to light showing that they had knowingly distorted climate risks.

The Prince of Wales told the forum that “climate change is becoming an increasing source of risk to the finance community” and asked whether the time had come for investors to divest from fossil fuels and switch to green alternatives.

“Some investors, such as philanthropic trusts and foundations, will also have to consider whether continuing to invest in high-carbon assets represents a significant conflict to their overall mission and objectives.”

Carbon Tracker, a think tank of former City bankers, said the fundamental risk for the oil, gas and coal industry is that it continues to project a 30pc-50pc increase in fossil fuel use (and implicitly a four degree world) over the next quarter century as if nothing had changed, when global leaders are calling for a cut of 40pc-70pc by 2050.

![]()

The conflict is glaring. Fossil companies are in effect discounting the risk that governments will impose a rising carbon tax that gradually renders their business model obsolete.

Anthony Hobley, the group’s chief executive, said these companies still have time to adapt to the new world order and take the lead in renewable energy, storage technology and carbon capture – and some, such as Shell, are doing so – but they cannot avoid the issue. “They face the potential of massive value destruction if they try to fight the transition,” he said.

Mr Hobley said there is a historical graveyard of industries and companies that stuck doggedly to business as usual at key inflexion points. “Incumbents invariably fail to see it coming,” he said.